Income tax sections nobody knows about

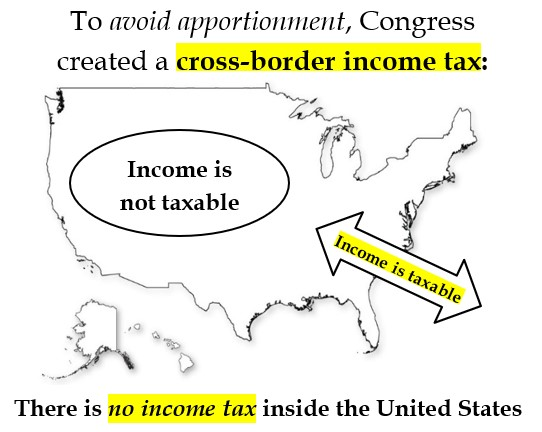

For over a century—since 1913—the Department of Justice has enforced an income tax inside the United States that does not exist in the statute. Generations have been led to file and pay under rules that never applied domestically. The Internal Revenue Code contains cross-border rules—left intact after the Sixteenth Amendment—that limit the income tax to income that crosses national borders.

The crucial sections do not reference one another. Congress omitted cross-references to Section 7701, where the terms “individual,” “person,” and “taxpayer” are defined as foreigners outside the United States. Without cross-references, familiar words are read in plain English and the tax is misapplied inside the United States.

Congress also omitted cross-references to Subchapter N, titled “Tax Based on Income From Sources Within or Without the United States.” These source rules classify income legally, not geographically. Together with Section 7701, they show that the income tax applies only when income crosses national borders—either to foreigners outside the United States, or to citizens or residents inside the United States when income is foreign or paid by a foreign employer.

Income earned entirely inside the United States is not included. This cross-border structure has existed since 1862. It has been misapplied for generations by judges who disregard these rules and substitute opinions for the written law. But judicial opinions are NOT the law.

Meet Tom Clayton, MD

Unmasking the Crucial Sections

Dr. Tom Clayton, a seasoned medical professional with a background in pure mathematics, has always insisted that rules must be obeyed exactly to avoid mistakes. With no quality issues during his entire medical career, he wanted to know why tax advisors and the IRS had been making repeated mistakes over the same time span.

What was being universally misunderstood? Congress has used the same indirect, cross-border structure since 1862. The written rules have always applied only when income crosses national borders, not to citizens or residents inside the United States with purely domestic income. The later assumption of a domestic income tax came from courts, not from the statutes.

In 1916, Congress repealed the 1913 domestic tax and left in place the current system, which functions like a tariff through the “Cross Border Rules.” Because the statutes omit direct references to the 7701 definitions and the Subchapter N source rules, experts have assumed a domestic tax that Congress has never imposed.

Tom Clayton, MD

Insights You'll Gain from This Book

● Legal Definitions Unveiled: Section 7701 defines “persons,” “individuals,” and “taxpayers” as foreigners outside the U.S. By omitting references to these crucial legal definitions, plain English meanings have resulted in the tax being misapplied inside the United States.

● The Hidden History: Despite ratification of the 16th Amendment in 1913 removing the apportionment requirement for direct income taxes, Congress continued the cross border tax it had imposed since 1862. To the present day, there has never been a federal income tax inside the United States.

● Why It Matters Today: Search engines now allow anyone to read the law directly without federal interference. They can see for themselves that the tax applies only to foreigners outside the United States with income from inside the United States, and to U.S. citizens or residents inside the United States with foreign employers, not to purely domestic income that does not cross national borders.

Real Reactions From Readers

“Tom’s book opened my eyes. It’s easy to read and uses search engines to prove that the income tax only applies to income that crosses the borders of the United States.”

– A.W., Lawyer

Why should you buy?

Advantages of Buying This Book

-

100% Based on Statutory Law

Every fact in this book comes directly from the Internal Revenue Code. No assumptions, opinions, or interpretations.

-

Finally See the Law for Yourself

This book shows you the legal definitions that everyone, judges included, must obey to apply the tax correctly—but none do so.

-

Clarifies When Tax Actually Applies

Learn why the income tax only applies when income crosses national borders, not to ordinary citizens or residents working inside the United States.

-

Exposes Why You’ve Been Misled

Discover how references to key sections were left out of the “determining taxable income sequence,” leading millions to pay taxes they never legally owed.

-

Proves the 1040’s Limited Scope

Understand why Form 1040 is only for reporting foreign income—and why it does not apply to citizens or residents with purely domestic income.

The rules change everything.

Absolutely eye-opening—everything changes when you understand the legal meanings of familiar words.

I thought I knew the tax code. Then I read this—and realized I’d been skipping the most important parts.

This book showed me the law in a way I’ve never seen before. It’s all there—just not the way we’re taught.

Clear once you read it right.

Following the law’s own sequence changed everything I believed about taxes.

Truth hiding in plain sight.

Once you read the crucial definitions, it’s impossible to unsee what’s really written.

It’s shocking how clear it is when you read it the way it’s written, not the way it’s explained by tax experts.

I was stunned—when you follow the rules exactly, the truth is nothing like what we’ve been told.

American Citizens inside the United States

By using the power of search engines and only the income tax law (IRC), NOT the regulations, IRS publications, or judicial opinions (which are not the law), American citizens can see that they are taxed only when their income crosses national borders (Subchapter N).

The IRC exposes the “Administrative State” — a web of unelected federal lawyers who act as judge, jury, and executioner, enforcing an income tax inside the United States since 1913, the first income tax of the 20th century.

Unmasking the Tax Code

Federal lawyers have enforced the income tax inside the United States by using plain-English meanings for familiar terms that have binding legal definitions. Because Congress omitted references to Section 7701 and Subchapter N, neither the public nor tax authorities know that citizens and residents inside the United States are only taxed when their income crosses national borders.

What This Means For You

Once you see the statutory definitions behind the most familiar words—and the withholding rules—you’ll recognize that the federal tax system has been misapplied inside the United States for more than a century. This book doesn’t persuade; it proves that the income tax has been enforced inside the United States by assumptions, not by law.

Get In Touch

Curious? Angry? Just want to know more? This book is for you. Reserve your Book now:

Note

This book does not tell anybody what to do or give financial advice. It uses search engines to show the law without federal interference proving the income tax only applies to income crossing national borders of the United States.